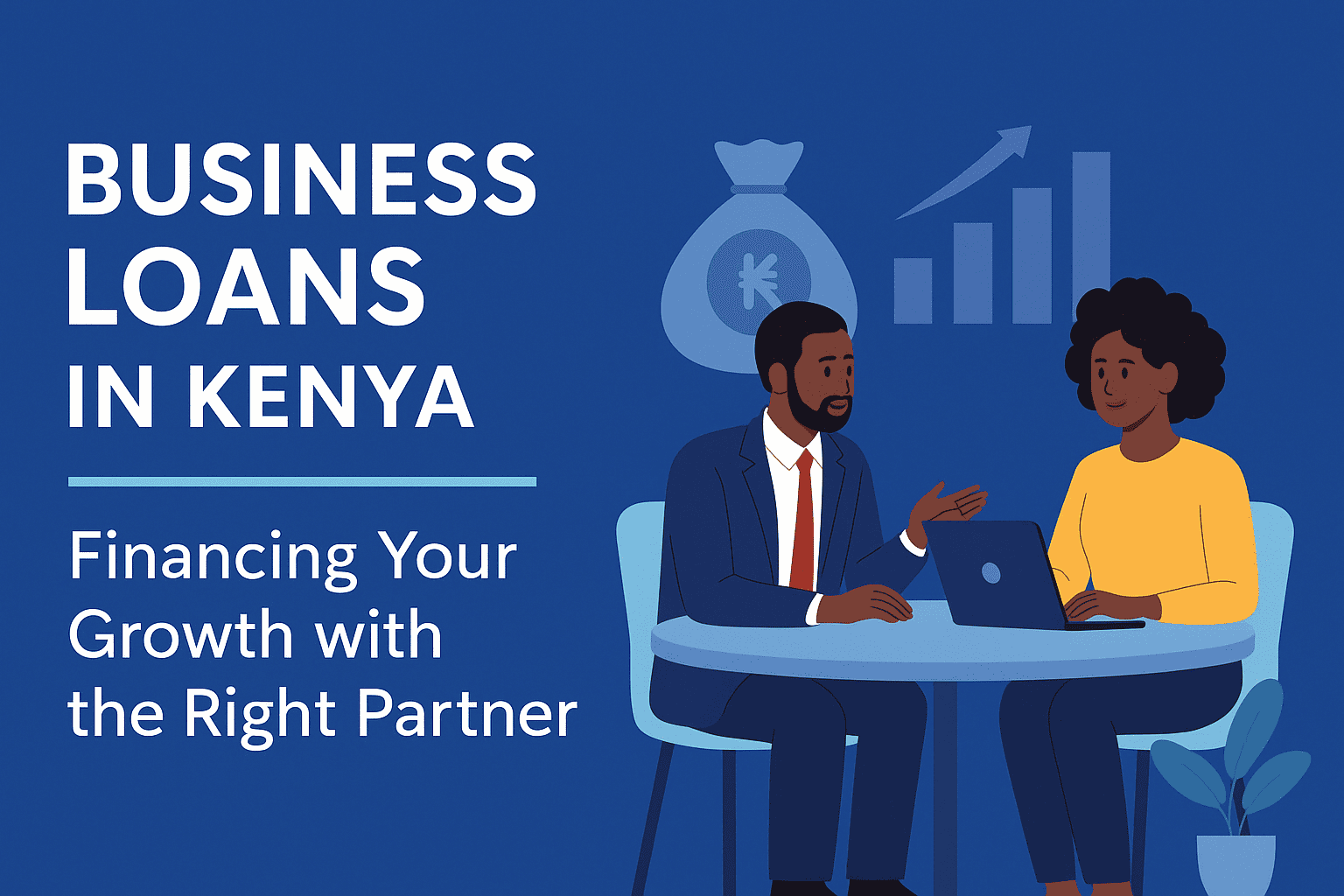

Access to credit is one of the biggest challenges facing Kenyan small and medium enterprises (SMEs). Whether you're starting a new venture or looking to expand your existing business, having the right financing can make all the difference in achieving long-term success.

Where Can You Get Business Loans in Kenya?

Kenyan entrepreneurs can access business loans from a wide range of financial institutions:

- Commercial Banks (e.g., Equity Bank, KCB, Co-op Bank, Absa)

- Microfinance Institutions (e.g., Faulu, SMEP)

- Saccos

- Mobile-Based Lenders (e.g., M-Shwari for Business, TALA Business)

- Government-backed Funds (e.g., Hustler Fund, Youth Fund, Women Enterprise Fund)

Each of these lenders offers tailored financing options to meet the needs of traders, agribusiness owners, manufacturers, and service providers.

Types of Business Loans You Can Access

Here are the most common types of SME loans available in Kenya:

- Working Capital Loans – To manage daily operations and cash flow.

- Asset Financing – To acquire equipment, vehicles, or machinery.

- Invoice Discounting – To get immediate cash based on pending invoices.

- Overdraft Facilities – For short-term funding to meet urgent needs.

Bank loans often come with structured terms, collateral requirements, and credit checks, while saccos and microfinance offer flexible options with lower entry barriers.

Rise of Mobile-Based SME Lending

Apps like KCB-MPesa, TALA Business, and M-Shwari for Business are now enabling quick access to microloans for small traders. These platforms offer:

- Fast disbursement

- Minimal paperwork

- Shorter repayment periods

However, they often come with higher interest rates, so they are ideal for urgent or short-term needs only.

What You Need Before Applying

To qualify for a business loan:

- Prepare a solid business plan

- Have clear records of cash flow

- Ensure your business is legally registered

- Separate personal and business finances

This shows lenders that you’re running a credible and sustainable business.

Government Support for Entrepreneurs

Kenyan government funds such as the Hustler Fund, Youth Fund, and Women Enterprise Fund offer affordable financing to empower underrepresented groups. These options often come with:

- No or minimal interest

- Grace periods

- Community group guarantees

Final Thoughts

With so many options available, choosing the right business loan in Kenya depends on your goals, repayment ability, and urgency. Tools like Pesa Trends help you compare different loan offers from trusted providers all in one place.

Take the time to research, plan carefully, and make borrowing decisions that support your long-term business growth and sustainability.