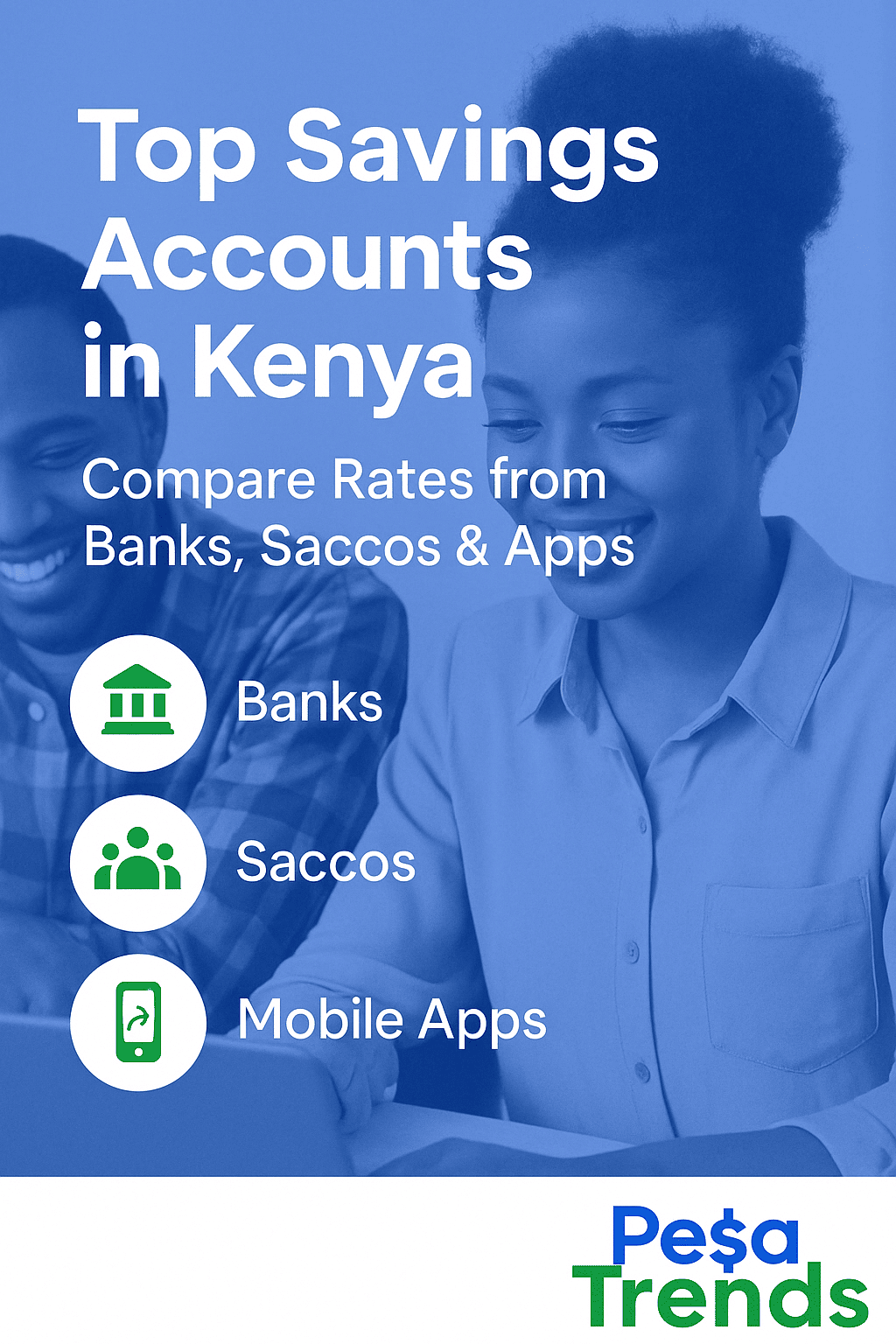

In a world where financial stability is more important than ever, choosing the right savings account can make a significant difference in how your money grows. In Kenya, savers now have more options beyond traditional banks—Saccos and mobile apps have entered the scene with competitive offerings tailored for different lifestyles and income levels.

So, which savings account is best for you? Let’s break down the key players and what they offer.

🏛️ 1. Banks: Reliable and Regulated

Commercial banks remain the go-to for most Kenyans seeking secure savings accounts. Institutions like Equity Bank, KCB, Absa, NCBA, and Co-op Bank offer various account types—regular savings, junior saver, and fixed deposit accounts.

- Interest Rates: Typically range between 2% to 5% annually, depending on the minimum balance and deposit frequency.

- Account Features: ATM cards, mobile banking, standing orders, and account insurance.

- Best For: Salaried individuals and business owners seeking reliability and additional banking services.

💡 Tip: Look out for hidden fees such as monthly ledger fees, withdrawal charges, or ATM card maintenance costs.

👥 2. Saccos: High Returns with Member-Driven Values

Saccos (Savings and Credit Cooperative Organizations) are popular among civil servants, teachers, and small business owners. Unlike banks, Saccos are member-owned, meaning profits are shared back with savers in the form of dividends and interest.

- Interest Rates: Can go as high as 6% to 10% per year depending on surplus performance.

- Account Features: Loan eligibility tied to savings, no minimum balance in some cases, and community-driven values.

- Best For: Long-term savers, rural dwellers, and anyone interested in accessing affordable loans later.

💡 Tip: Saccos require a membership fee and consistent savings for loan qualification. Ensure it’s SASRA-registered before committing.

📱 3. Digital & Mobile Wallet Savings: Fast, Flexible & Convenient

Kenya’s fintech boom has birthed mobile-based savings solutions like:

- M-Shwari (Safaricom + NCBA): 6.65% annual interest, minimum balance KSh 1.

- KCB-MPesa: Offers a saving feature with up to 6.3% interest.

- Airtel Money Lock Savings: A less-known alternative with flexible terms.

- Absa Timiza: Blends savings with mobile loans.

- Best For: Youth, digital-savvy individuals, and short-term goals like emergency funds or business capital.

- Pros: Instant setup, no paperwork, and accessible 24/7.

💡 Tip: While these platforms are great for convenience, they may not offer the highest returns in the long term.

🧮 Final Thoughts: What Should You Compare?

When choosing a savings account in Kenya, consider:

- Interest rate & compounding frequency

- Minimum balance requirements

- Ease of deposit/withdrawal

- Additional services (e.g., loan eligibility or mobile access)

- Fees and penalties

✅ Pesa Trends Can Help

At Pesa Trends, we simplify your decision-making by helping you compare savings accounts from Kenya’s top banks, Saccos, and mobile platforms—all in one place. Make your money work smarter by finding the perfect account for your needs today.